Highlights Of The Mini Budget Pakistan 2018-19

- Escape Solutions

- Jul 10, 2018

- 1 min read

Updated: Oct 8, 2018

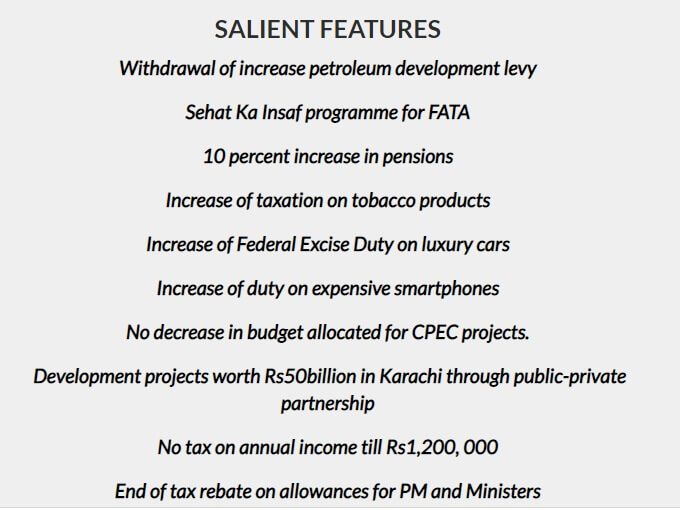

Being a revised version of former government’s budget, the new plan highlighted the protection of the poor and flow of taxes to those who earn more.

It aims to elevate agriculture so they support exports, create jobs and earn foreign exchange.

Development (Schools, Clinics, Roads)

The development budget has been raised 10% from Rs 661 billion to Rs 725 billion.

Rs 50 billion will be spent on Karachi projects

CPEC projects will continue without any cuts

Taxes On Income

Upto Rs 400,000 – Exempt

Rs 800,000 – Rs 12,00,000 – Rs2,000

Rs 12,00,000 – Rs 24,00,000 – 5% fixed tax

Rs 24,00,000 – Rs 30,00,000 – Rs 60,000 fixed tax

Maximum tax for salaried class – 25%

Maximum tax for non-salaried class – 29%

Tax On Non-Filers

0.6% tax to be charged non-cash transactions above Rs 50,000 (up from 0.4%).

The ban on non-filers purchasing new assets removed

Items To Become Expensive

Duties on 300 luxury items, including luxury cars, imported food, make-up, and high-end mobile phones, to be raised

Duties on cigarettes to be raised

20 percent duty placed on 1800cc vehicles

Subsidies

Rs 100 billion to be given as a subsidy in the petroleum tax

Farmers to attain subsidies of up to Rs 7 billion on fertilizer purchases

Punjab-based industries to get gas at subsidized rates as Rs 44 billion have been allocated.

Rs 4.5 billion subsidies for the construction of 8,276 low-cost houses for the labor class.

Health card announced for residents of Islamabad and FATA to provide a subsidy of Rs 540,000 per family.

Duties removed from 82 imported items that are used in export-oriented industries and announced an Rs5 billion subsidy for this purpose.

Pension Increase In Budget 2018-19

10% pension has been increased for low-income pensioners (about 85% of total pensioners).

Comments